Irs 2024 Schedule C – There are other tax changes happening next year that could put more money in your paycheck. If you collect Social Security, you’ll receive a 3.2% cost-of-living-adjustment in 2024. And since the first . The IRS has announced its 2024 inflation adjustments. And while U.S. income tax rates will remain the same during the next two tax years, the tax brackets—the buckets of income that are taxed at .

Irs 2024 Schedule C

Source : carta.com

What Is a Schedule C IRS form? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Green Books Cannabis Accounting

Source : m.facebook.com

FACTS Flyer 2023 2024 Padua Franciscan High School

Source : paduafranciscan.com

When To Expect My Tax Refund? The IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.com

Here’s who qualifies for IRS’ free ‘Direct File’ pilot program in 2024

Source : www.cnbc.com

Property Management Tax Reporting Made Easy | Buildium

Source : www.buildium.com

Corporate Consulting LLC | Irmo SC

Source : m.facebook.com

MMNT Certified Public Accountants on LinkedIn: Connecticut’s 2024

Source : www.linkedin.com

M & J Services | La Villa TX

Source : www.facebook.com

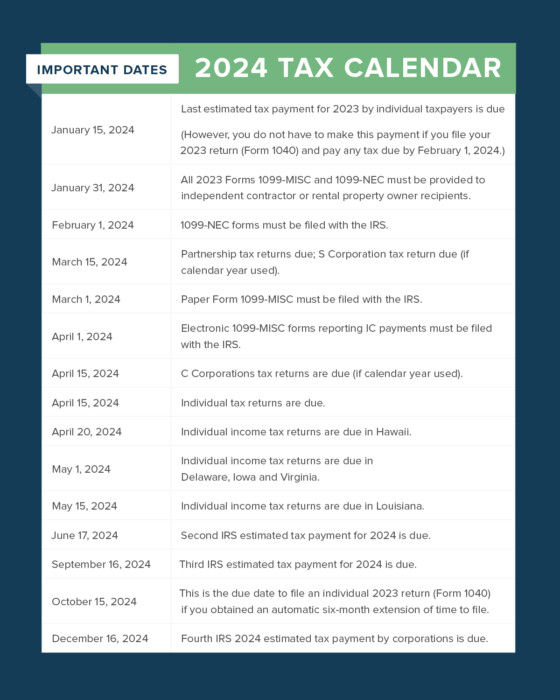

Irs 2024 Schedule C Business tax deadlines 2024: Corporations and LLCs | Carta: Once again, the IRS has delayed implementation of new rules that would have resulted in a Form 1099-K being sent to more than 30 million Americans who received payments this year through PayPal, Venmo . The Internal Revenue Service has announced that income tax brackets and standard deductions will be changing come the 2024-2025 season. The IRS released the information Thursday in its annual .